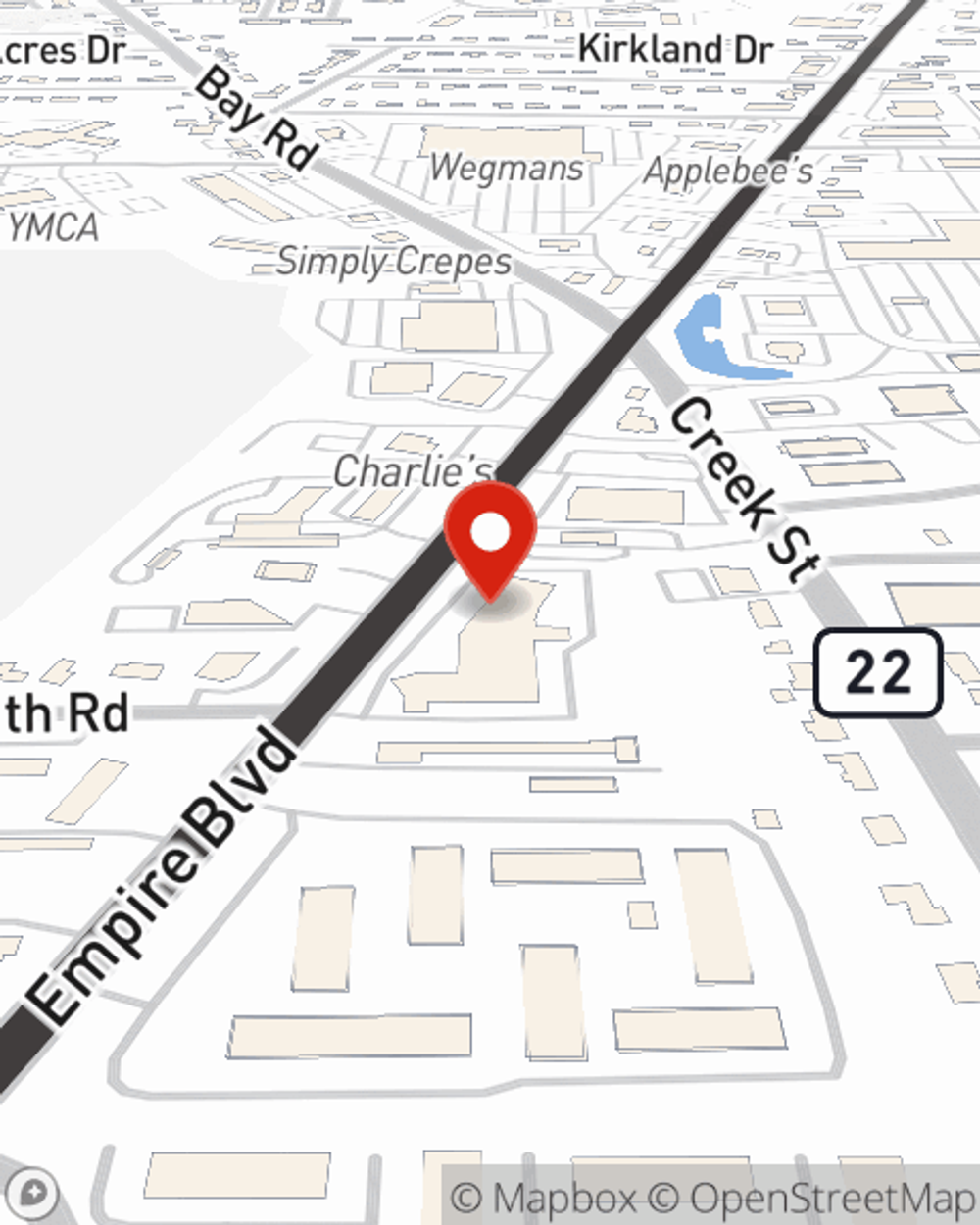

Business Insurance in and around Webster

One of the top small business insurance companies in Webster, and beyond.

Almost 100 years of helping small businesses

Insure The Business You've Built.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all by yourself. State Farm agent Jerry Christopher, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you customize a policy that's right for your needs.

One of the top small business insurance companies in Webster, and beyond.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

For your small business, whether it's a funeral home, a donut shop, a lawn care service, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like equipment breakdown, accounts receivable, and loss of income.

Get in touch with the exceptional team at agent Jerry Christopher's office to help determine the options that may be right for you and your small business.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Jerry Christopher

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.